Grounds education loan debt in the finances

Review financing terminology very carefully

Entrepreneurs exactly who not be able to satisfy regular providers loan conditions is to be wary from predatory lenders that aren’t transparent regarding true price of borrowing from the bank. Before accepting financing render, Elliott suggests parsing out the apr and you may conditions, together with studying if or not there are even more fees, particularly good prepayment punishment.

If the mortgage price musical too good to be real, it most likely are, warns Carolina eo, California’s statewide micro team system.

Which have any financing offer, Elliott says to take time to determine, Must i be able to get this to percentage and you can carry out the things i need to do for the currency that’s are borrowed?’

Seek professional help

Its as important to get ready to incorporate because is essential to determine the proper product, says Martinez.

100 % free information, for example Score training and you may sessions away from CDFIs, may help advertisers optimize the application and you will prepare yourself to respond to one concerns lenders may have.

For those who have an excellent providers idea or best to grow your organization, and you also consider that loan makes sense for you, you shouldn’t be delayed since you has actually student loan or any other personal debt, states Katz. Give it a try. No matter if you happen to be turned-down, she demonstrates to you, lenders tend to give you an explanation as to why.

- Text messages

- Texts

- Printing Content article link

You can find forty five mil People in america who possess education loan loans, and also for entrepreneurs, this may build being qualified to have a small-company financing much harder. Education loan financial obligation could affect your credit score and financial obligation-to-earnings ratio – a couple section lenders used to examine a borrower’s likelihood of defaulting. not, you’ll rating a business financing having scholar obligations.

Many times, I might state half of all of our finance – more you to definitely – features scholar financial obligation, says David Canet, controlling director of SBA Financing Group from the ConnectOne Financial.

Exhibiting your online business have enough income to handle providers loan money might be an obstacle when it comes down to installment loan company Jacksonville FL entrepreneur, but specifically those that have beginner obligations.

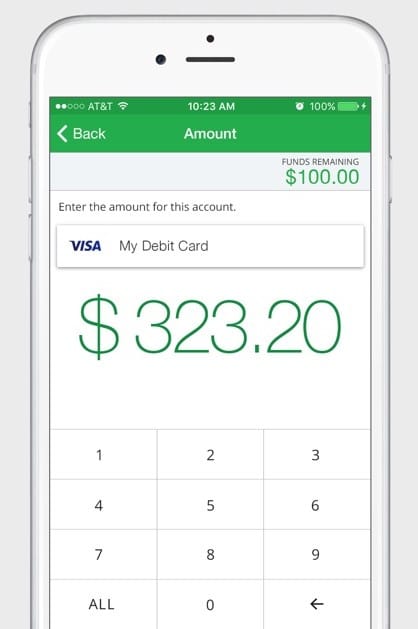

Your own organization’s income should be able to support personal expenditures, for example student loan money, near the top of team financing payments, Canet teaches you. Education loan loans plus influences the debt-to-earnings ratio, good metric lenders use to determine your ability to settle an excellent loan. Canet advises adding your own budget towards business strategy in order to demonstrate that you’ve put think into your private obligations, including education loan money, also team of them.

[Lenders was] not most likely responding far to all the information throughout the personal debt termination and stuff like that, even though it is so complicated, claims Carolyn Katz, a get coach which facilitate brief-advertisers submit an application for money. So they can work out who could get which degrees of loans terminated in the just what area could be significantly more than the pay grade.Student loan loans may also perception your credit rating, and you may lenders check your credit rating to find out if you generated money constantly throughout the years. For folks who haven’t, you aren’t by yourself, states Katz. Most of the business owners this woman is caused has anything negative (such as for instance a skipped student loan payment) to their credit history.

What counts is the fact you may be forthcoming towards reason behind a beneficial struck on the borrowing from the bank. So it, Katz explains, allows the lender be aware that you are sure that exactly what becoming a responsible debtor form.

Envision strategies to make your credit score, and anticipate loan providers to get deeper focus on other factors such as for instance your hard earned money flow and exactly how far equity you may have, says Desha Elliott, a district markets manager within Accion Chance Funds, a good nonprofit lender and you will society innovation standard bank, or CDFI.

No comments